ERP Business Processes

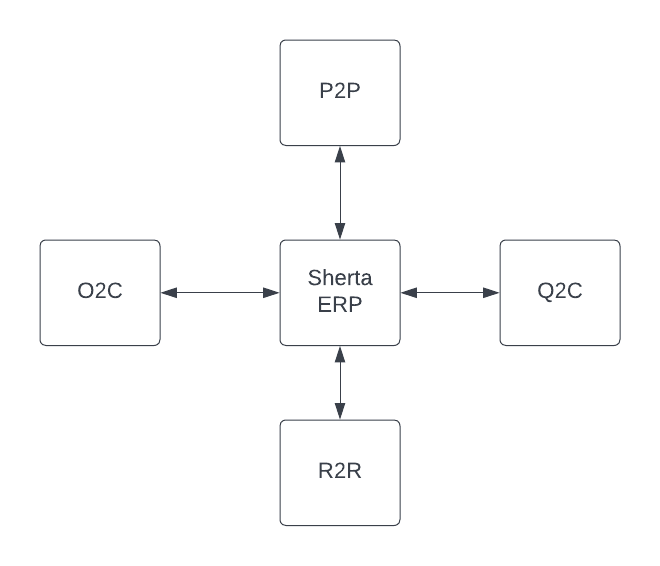

Sherta ERP automation offers the P2P, Q2C, R2R, and O2C processes that are critical to any business, essential to optimally manage business operations. However, this can be a difficult task, as each step is complex and time-consuming to handle, particularly for companies still dependent on slower manual methods. Outdated sequences mean shuffling through mountains of paperwork (paper requisitions, POs, invoices, and many more, sometimes inscrutable documents). Understanding them, routing these documents to the appropriate parties, and handling all of the data associated with them is what overwhelms operations. Moreover, disparate systems and human errors make these processes costly and onerous for already overworked sales, accounting, and finance teams, depressing overall business output. But organizations in the UAE can lift this burden from teams by automating these processes with Sherta ERP solutions. The result, if implemented properly, is a guarantee of integrated procedures that reduce inefficiencies and increase transparency across the company. It ends the siloed processes in disparate enterprise systems, eliminating manual data entry, process inefficiencies, ensuring compliance, and making KPI goals more sustainable. In the process, employees are freed up to focus on more critical tasks, boosting their productivity.

Procure-to-pay (P2P) is on the supply side of the company, where items are bought from external vendors or suppliers and stocked up in the inventory, carried out by teams responsible for making purchases. It includes requisitioning, purchasing, receiving, invoicing, and paying for goods and/or services. The ERP allows these overarching steps:

1. Need identification: This first step involves the purchasing department, which identifies what’s required, which potential vendor is the best fit, and how much the goods or services will cost.

2. Purchase Requisition: Next, the department must create a requisition, an internal-facing request that accounting must review for purchase. If accounting approves the requisition, the purchasing department will send a document called the purchase order (PO)—the official, external-facing purchase request—to the external vendor.

3. Approval of the Purchase Order: Purchase order approval takes several rounds of internal and external modifications, quantity adjustments, or price negotiations.

4. Goods received and invoice: Once the purchased goods and/or services have been received, the vendor will send an invoice. This is what the accounts payable team will then use to begin the payment process.

5. Vendor Payment: The accounts payable team enters the vendor invoice into the accounting system, where it can pass through the appropriate approval process, ensuring that the external vendor or supplier eventually gets paid out.

Quote-to-cash (Q2C) is part of the sales process through which quotes are created for customers who buy the product or services that are being sold. Marketing and various forms of prospecting aren’t included, but activity that leads to a sale is, including price quotation, closing the sale, and receiving payment.

Each of these is traditionally separate in the Q2C process but is efficiently braided into the ERP:

- 1. Understanding customer requirements: The first step is when the sales department works with a potential customer to determine the specifications and details of the product or service they’re interested in buying.

- 2. Setting up a pricing structure for the sale: Once the salesperson understands precisely what the customer needs, they determine the pricing structure based on internal business parameters like cost price, margin requirements, surcharges, and discount provisions.

- 3. Negotiation and final quote: The salesperson presents the initial quotation to the customer. Depending on their constraints and expectations, if the customer decides they want the product, quantities and price may be negotiated before a final price is agreed upon and a finalized quote is generated.

- 4. Contract and sales invoice: After the customer has agreed to the final quote, the sales team develops a formal sale contract, and the accounting department generates a sales invoice.

- 5. Payment processing is the same as in the O2C process outlined above under O2C.

Order-to-cash (O2C) is the end-to-end procedure for order processing, usually through a point of sale (PoS), online, or other retail order management systems. It starts with a sales order and ends with a customer payment.

1. Customer orders: The O2C cycle begins once a customer places an order for goods or services through any of the order management systems available to a business.

2. Order fulfillment: Once an order has been placed, the product is prepared for shipment, or, in the case of a service, an appointment is scheduled with the customer.

3. Shipping orders: Next, the product is shipped to the customer or the service is fulfilled at the proper date and time.

4. Invoicing: After the product has been received or the service has been completed, an invoice is generated and sent to the customer for payment.

5. Payment processing: The accounts receivable team will send a formal receipt of payment to the customer when a payment is received and the payment is noted in the accounts under the specific details of the customer and transaction.

- Depending on what is sold, provisions are implemented to monitor the contract to ensure

- that the customer gets what they’ve paid for, including any maintenance or warranty services, and

- that the customer’s data is used in upselling later with their consent for follow-up needs based on the history of sales.

Record-to-Report (R2R) is usually used in dashboards (snapshot reports) and in customized detailed or drill-down reports for viewing various business and accounting key performance indicators. Armed with that knowledge, a company can gain better operational insights, ensure adherence to compliance, improve productivity, and make more informed business decisions. It’s essential for strategic planning, accurate financial and operational transparency, and improving integrated business functions for a healthier business bottom line. This process generally includes the entire gamut of collecting, processing, and delivering the information businesses use to make pertinent financial and accounting decisions.

- 1. Data extraction: The first step to studying business data is to identify the source, format of extraction/archiving or methods of display. This data is stored in the relational database that sits at the center of the ERP. It can be obtained by running queries against the database for the time duration needed. Any user-defined parameter is usable, and usually selectable ranges including monthly, quarterly, and annual are common.

- 2. Data sets: Once all the proper data has been extracted, it will then need to be collected in a system of analysis for review. This allows you to more easily understand the data, as it creates a bird’s-eye view of information from disparate and complex sources. This partitioning helps with drilling down and nested grouping as well. Usually domain-agnostic, a lot of business data sets are standardized by their respective industries.

- 3. Data validation and custom filters: Next, the data that’s been extracted and collected can be validated to ensure further accuracy and compliance with business standards. Overlooked data entry errors become costly down the road. And further condensation of a useful piece of information is usually extremely useful in day-to-day operational settings. These can be customized and built as per specifications.

- 4. Key performance indicators translation: Confirmed and accurate data is interpreted and translated into meaningful key performance indicators (KPIs). These are formulaic, universally understood, standard business intelligent equations or ratios created from the stored data that serve to measure efficiency, productivity, and various statistical, mathematical, and business metrics for improvement.

- 5. Sharing reports and results: Finally, the departments can determine the best way to present the resulting report and share it with internal and external stakeholders. The information—which may differ depending on data complexity, business needs, and formatting requirements—is then ready to be used moving forward.